I’ve been playing around with Manifold Markets recently. Manifold is a fake money prediction market platform whose differentiator is that it allows anyone to create arbitrary prediction markets. Unlike other platforms1, that moderate market creation and resolution criteria, Manifold users can make whatever markets they want, with arbitrary resolution criteria.

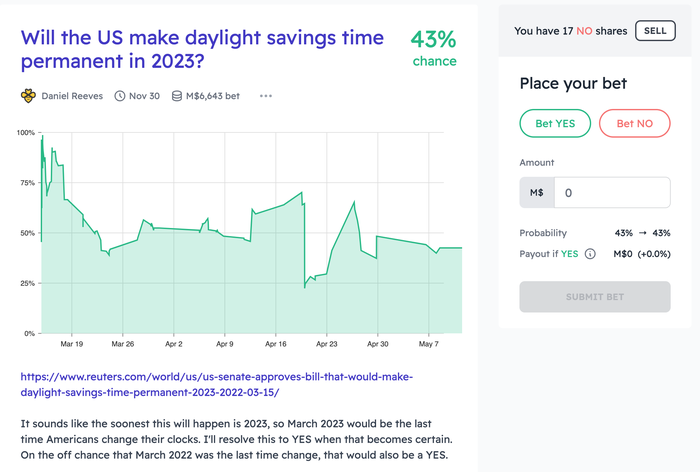

To get a sense of the flavor of this, one of the highest traded markets on Manifold for the first couple months was “Will Midnight the stray cat allow humans to pet her by April 1st, 2022?” There are also more serious markets, like “Will Ethereum merge to Proof-of-Stake by July?”, and “Will the US make daylight savings time permanent in 2023?”

The Manifold Market for making DST permenant in 2023

Feature request markets: Part of my excitement in Manifold is that it’s iterating on its design pretty rapidly. In the time that I’ve been using it, they’ve experimented with adding loans for placing market bets, added the ability to resolve a market with a probability (vs. YES/NO), and began allowing users to donate their funds to selected charities. There’s a ton of other ideas that they’ve floated on Twitter.

Naturally, there are also feature request markets (e.g. 1, 2, 3). 😄

Counterparty Risk: One interesting outcome of Manifold’s design that market proposers control resolution is that there is a nontrivial amount of counterparty risk in market resolution. Markets like “Will 1=1 on January 1st 2023?” and “This question will resolve positively on the 1st of January, 2023” explore this idea. There’s nothing stopping the “1=1” market proposer from resolving “NO”, other than the reputation hit. Since the market creator has total power to decide the resolution, betting on these “sure” markets is essentially a bet on (1) the reputation of the market creator, and (2) that the market creator will actually resolve the market at all.

Manifold’s AMM: Manifold’s market system takes a page from automated market makers (AMM) in the cryptocurrency space in the way that liquidity is handled. Instead of requiring a bidder on the other side of your bet, each market has a liquidity pool. Every time you make a bet, you’re adding liquidity to the market and receiving an amount of shares in the direction of the resolution you’re betting on (e.g. “YES” shares vs. “NO” shares). This leads to somewhat counterintuitive dynamics, but works relatively well from what I’ve seen.

There’s more details about the Manifold AMM algorithm (“Maniswap”) on their Notion site. I’ve been developing an interest in markets recently, so this is something I’d like to dig into deeper in the future.

One nice benefit of this liquidity pool approach is that it handles “thin” markets better than a traditional order book based approach. Since Manifold’s markets are intended to be plentiful, the amount of bidders in the “long tail” of markets is relatively small. The liquidity pool approach means that “trades” can execute instantly, since each bet is only adding or removing liquidity from the market. As such, the market probabilities are deterministic from the number of shares in the market at any given time. Neat stuff.

Experimenting with market creation: Recently, Manifold added a feature that allows you to create a market “for free” – they front a small amount of liquidity to get the market started. (Previously, the market maker had to subsidize market creation with their own funds.) As a result, I’ve been trying my hand at creating some markets. Here are the ones I’ve created so far:

- Will there be a COVID-19 related story on the front page of the NYTimes in the week of December 1-8, 2022?

- Will Seattle, WA have 5 or more days of bad air quality in the summer of 2022?

- Will Vanguard’s Total Stock Market Index Fund (VTI) close higher on any day in the rest of 2022 than its 1/3/2022 closing price?

- Which novel will win the 2022 Hugo Award for Best Novel?

- Will “Recession” have a higher average Google Search Trends score than “Inflation” in the week ending on May 31, 2022?

Manifold fills an interesting niche in the current slate of prediction platforms, and of the ones I visit regularly, Manifold feels the “freshest” from a UX perspective. It’s also open sourced on Github! (They use Cloud Firestore, which I have an admittedly biased soft spot for.)

-

For example, Metaculus, Kalshi, PolyMarket, etc. ↩︎